The Cayman Islands have a lot more to offer than just stunning beaches and fantastic weather. It's an excellent option for maximizing your financial growth. Our financial hub offers secure fixed deposit options that can assist investors in growing their savings.

Opening a high-yield certificate of deposit (CD) account with a reputable bank is a wise financial decision. Residents of the Cayman Islands can take advantage of a wide range of savings opportunities thanks to the strong economy. This place caters to a wide range of investment needs by providing reliable fixed deposits. Investors can steadily accumulate wealth in a robust economic climate.

Understanding Certificate of Deposit (CD) Rates in the Cayman Islands

These CD accounts frequently offer higher interest rates compared to other jurisdictions, as well as confidentiality and robust asset protection. Global economic conditions and local stability play significant roles in fixed deposit investments in the Cayman Islands, making it crucial to understand CD rates before making any decisions.

If you're looking to grow your investment portfolio, familiarizing yourself with certificate of deposit (CD) rates in the Cayman Islands is essential. This country, as a well-known offshore banking destination, provides substantial opportunities for high investment yields.

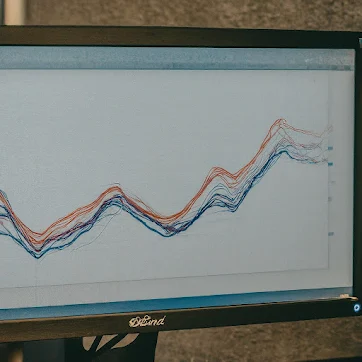

Let's examine how CD rates work on a global scale while considering relevant economic indicators and policy effects. Are you familiar with the terms of a bank certificate of deposit?

Advantages of Cayman Islands CD Investments

A certificate of deposit (CD) is a banking product that offers higher returns than a regular savings account. By keeping your money untouched for a set period, you can earn a competitive interest rate on your CD. Cayman Islands CD Rates, in particular, provide attractive rates for global investors, along with tax benefits and strict privacy laws.

Unlike other offshore banking centers, the Cayman Islands stand out by offering unique advantages and favorable conditions for CD investments. Setting interest rates necessitates careful analysis of a variety of factors, including market conditions, economic indicators, and policy decisions from institutions such as the Federal Reserve.

While policies from the European Central Bank may lead to lower yields in other countries, investing in Cayman Islands CDs could potentially generate higher returns, depending on the size of your investment. Remember, certain taxes and regulations may still apply to the interest you earn on your savings.

Security and Stability of Cayman Islands CD Investments

However, if you choose to invest in the Cayman Islands, you can take advantage of their tax-free environment and transparent reporting requirements. This appeals to investors worldwide who value not only profitable investments but also secure and advantageous financial management strategies. The Cayman Islands boast asset protection laws that safeguard your wealth, not only for yourself but also for future generations.

With a politically stable and debt-free environment, the banking system provides investors with a sense of security. Choosing to invest in bank CDs in the Cayman Islands offers compelling tax advantages and premier asset protection. Bank-zero-direct taxation enhances CD returns, while solid legal protections ensure confidentiality.

The stable economic and political climate ensures investments are safe, and compliance with global regulatory standards promotes transparency.

Appeal and Reliability of Cayman Islands CD Investments

The Cayman Islands are a top choice for investors seeking a competitive edge in the international market. In times of economic uncertainty, these islands offer a safe haven for preserving and growing wealth. This is evident in their high CD rates, which prioritize depositor security and strong investment opportunities.

With this dual focus, the Cayman Islands Bank CD Rates remain a leading choice for savvy investors worldwide. Global economic trends, major bank actions, and the state of the local economy all play an important role in determining CD rates.

In order to remain competitive and attractive to investors, banks must adjust these rates accordingly. So what specific advantages do Cayman Islands bank CDs offer investors? These accounts provide numerous benefits, such as tax advantages, asset protection, and financial stability.

Considering Cayman Islands CD Rates for Financial Growth

Additionally, they also ensure legal safety and privacy for account holders. For those seeking stability and privacy in their investments, Cayman Islands bank CDs are an excellent option. If you're curious about the current CD rates in the Cayman Islands, it's best to contact the banks directly for accurate information.

While these rates may vary with economic changes, CDs still provide a secure chance for fixed-term investments. What distinguishes Cayman Islands CDs as a favorable investment option? Its combination of competitive interest rates, tax benefits, and strong laws protecting privacy make it an appealing option for wealth growth and preservation in a stable economy.

Ultimately, when it comes to investing, having a dependable and safe investment option is crucial.

The Reliability and Stability of Cayman Islands CD Investments

Thankfully, the Cayman Islands Certificate of Deposit offers just that with its reliable track record and attractive features, making it a popular choice among investors looking for security and steady growth. A reputable banking system ensures that investors have peace of mind when depositing their funds in the Cayman Islands. They have long been associated with financial stability and robust regulations.

Furthermore, the government's commitment to maintaining a stable economy strengthens the Cayman Islands' appeal. As a result of the Cayman Islands CD's fixed-term nature, investors can lock in their funds for a predetermined period, avoiding market fluctuations and uncertainties. With this fixed rate of return, investors can plan for their financial future with confidence because it provides stability and security.

Cayman Islands CDs are a reliable and secure investment option for those seeking to grow and preserve their wealth. Its stable economy, reputable banking system, and fixed-term nature have made it a popular choice for long-term investors. For those looking for a reliable and solid option, a Cayman Islands CD is a good choice, whether it's for personal savings or business investments.

The Cayman Islands have long been known as a premier offshore financial center, attracting investors from around the world. Among the many investment options available, Cayman Islands certificates of deposit (CDs) have gained popularity for their reliability and stability.

The appeal of a Cayman Islands CD lies in its strong banking system and investor-friendly regulations. The island's robust financial infrastructure ensures the security of funds, making it an attractive choice for those seeking a safe haven for their savings. Additionally, the transparency and efficiency of the banking sector provide peace of mind to investors, knowing that their assets are well protected.

Choosing Cayman Islands CDs for Financial Security and Growth

Whether you're an individual looking to grow your personal wealth or a business seeking an opportunity for stable returns, a Cayman Islands CD offers a compelling option. With competitive interest rates and flexible terms, these CDs cater to different investor preferences and goals.

Whether you're looking for short-term liquidity or long-term growth, you can find a CD that suits your needs. Furthermore, the tax advantages offered by the Cayman Islands make these CDs even more tempting for investors. The absence of income, capital gains, and tax withholding frees up more of your investment returns, maximizing the potential for wealth accumulation.

Political and economic stability on the island, combined with a favorable tax environment, fosters a secure and profitable investment environment. In conclusion, a Cayman Islands CD is an excellent choice for those seeking a reliable and solid investment option.

With its reputable banking system, investor-friendly regulations, competitive interest rates, and attractive tax advantages, a CD in the Cayman Islands offers peace of mind and long-term growth. Whether you're saving for retirement, planning for a major purchase, or looking to diversify your investment portfolio, consider the benefits of a Cayman Islands CD. All in all, investing in a Cayman Islands CD can be a great decision for those looking to secure their financial future.