Welcome to Luxury FintechZoom. This place brings together the latest in rich investment news and high-tech finance. If you're someone with considerable wealth, understanding luxury wealth management is key. It can make your financial journey both sophisticated and innovative.

Here, we share exclusive insights into wealthy investing. This is where technology meets tradition, creating safe and rich financial futures. With our deep analyses and tailored content, we help you understand wealth complexities in today's digital world.

Key Takeaways

- Uncover the latest trends and breakthroughs in the high-end finance sector.

- Explore the transformative impact of technology on luxury wealth management.

- Gain access to exclusive, opulent investment news and analyses.

- Discover how fintech innovations are reshaping investment strategies for the affluent.

- Learn about the importance of sophisticated security measures in managing wealth.

- Stay ahead in the luxury financial market with forward-thinking insights.

- Benefit from Luxury FintechZoom focus on the intersection of financial expertise and technological advancement.

Understanding the intersection of FinTech and luxury is crucial.

Today, technology and luxury are more connected than ever. The FinTech luxury sector is changing how people manage wealth. It's a big shift, moving past old-school banks. It focuses on personal wealth management with new financial tools.

Rich people can now enjoy fancy services that mix luxury with the latest technology. This changes how they handle their high-end finances.

Defining FinTech in the Luxury Sphere

In the luxury world, FinTech means exclusive and high-end financial services. These services meet the special needs of rich clients. Advancements in digital technology help FinTech offer easy access to wealth management, investment strategies, and private payment options. These are both safe and private.

How Technology Enhances Luxury Financial Services

Today's technology makes luxury financial services more secure. It also creates services focused on the user. Technology works quietly behind the scenes. It helps personalize investment advice and wealth strategies based on each person's goals.

Personalized wealth management apps are becoming increasingly popular.

The luxury FinTech market is seeing more personalized wealth management apps. These apps learn and adapt to what users want. They combine daily account checks and smart investment advice. This makes sure every financial decision helps the user's overall wealth goals.

Spotlight on Luxury Fintech Innovations

The world of luxury wealth management is changing fast. This shift comes from cutting-edge financial technology aimed at helping rich clients. These aren't just small upgrades; they are huge changes that shake up how wealthy people manage their money.

Let's dive into the latest luxury wealth management innovation breakthroughs. Each new technology shows how these services strive for the excellence and top-notch care that wealthy clients look for. They're leading the way in this tech revolution.

- Integration of advanced data analytics to tailor investment portfolios

- Utilization of AI for predictive market behavior analysis

- Blockchain implementations for enhanced transaction security

- Interactive platforms that provide real-time financial insights

Let's closely look at major innovations. Today, they are changing the game with cutting-edge financial technology. They're not just ideas for the future. They are currently revolutionizing wealth management.

| Innovation |

Description |

Impact on Luxury Wealth Management |

| AI Financial Advisors |

We design artificial intelligence systems to provide bespoke investment advice and market analysis. |

Personalized portfolio management and real-time decision-making |

| Blockchain Technology |

Decentralized ledger systems that ensure secure and transparent financial transactions |

Increased trust and reduced risk of fraud in high-value transactions |

| Biometric Security Integrations |

Security solutions that utilize unique physical characteristics for user verification |

We have strengthened account access and prevented unauthorized financial activities. |

| Robust digital platforms |

Online wealth management ecosystems that harmonize financial services and client interactions |

We have streamlined the wealth management experience to improve client engagement. |

This sneak peek shows the vast luxury wealth management innovations for those seeking top financial service and flair. With ongoing advancements, these technologies promise a brighter, more connected financial world for the wealthiest investors.

High-end financial management trends

Financial management trends are rapidly evolving. Wealthy investors are looking for upscale investment strategies to protect and increase their wealth. We're seeing big changes that shift how rich individuals match their money management with their life goals and values.

- Sustainable and Ethical Investing: In high-end finance, there's a move towards investments that offer financial, social, or environmental gains. Wealthy investors prefer putting money into businesses that focus on corporate responsibility, green energy, and fair practices. They want their investment choices to help achieve global sustainability goals.

- Preference for Digital-Native Boutique Firms: With tech becoming a big part of finance, wealthy clients favor boutique firms that are born digital. These firms provide rich clients with advanced, tech-based advice and new views on managing assets that big, old banks can't offer.

- Holistic Wealth Management Services: There's a trend among wealthy individuals toward complete wealth management. It goes beyond usual financial advice by including aspects of their lifestyle in their financial plans. Wealth management now encompasses all aspects of a client's life, such as planning for the future, giving to charity, and managing family wealth rules.

These financial management trends reflect the complex and changing global economy. They also show the personal values of investors who expect more from their upscale investment strategies. High-end financial management will likely keep moving towards being more personalized, ethical, and linked with the latest technology.

The role of AI and ML in luxury fintech is significant.

Artificial intelligence and machine learning applications are changing luxury fintech. They bring a new age of data-driven investing. These technologies have a unique advantage. They assist in developing investment strategies, improving customer service, and managing assets more effectively.

Deep Learning for Bespoke Investment Strategies

Deep learning, a key part of machine learning, handles lots of complex data. It's essential for creating tailored investment plans. These plans match the specific goals and risks investors are willing to take.

Chatbots improve the customer experience.

Chatbots have changed how customer service works in luxury FinTech. These bots use machine learning to provide help at any time. They can answer questions, guide users, and share financial tips. This makes getting help easy and fast.

Real-Time Data Analysis for Luxury Asset Management

Now, managing luxury assets is proactive, thanks to real-time data tools. Investors keep track of their assets' performance. They receive updates on market movements. This helps them make quick and informed choices. Quick insights are critical in luxury finance. Timing has a big impact on investment returns.

| Asset Management Aspect |

Traditional Approach |

AI/ML-Driven Approach |

| Investment Analysis |

Periodic, potentially outdated reports |

Continuous, real-time analysis |

| Investment Strategy |

One-size-fits-all or manually tailored |

Fully customized, adaptive strategies |

| Risk Assessment |

Based on historical data and static models |

Dynamic utilizes predictive analytics. |

| Customer Service |

Traditional human-operated support |

Enhanced with AI chatbot assistance |

Security Features in Luxury Financial Technology

In luxury financial management, high-value assets move digitally. Security is a top priority. Fintech leaders innovate to deliver superior security features for wealthy clients. They focus on biometric security, blockchain for transactions, and strong data encryption.

Biometric verification for safe transactions

Biometric security fintech makes transactions very personal and secure. Methods like fingerprint scans, facial recognition, and retinal scans are now common. This ensures that only the authorized user can access and approve financial actions. It's crucial for those doing large, sensitive transactions.

Blockchain for Transparency in High-Value Deals

Blockchain is critical for securing and clearing high-value transactions. It uses a decentralized system to record transactions. This ensures that records remain unchangeable after the fact. For wealthy clients, blockchain means transparency, traceability, and security, which build trust with investors and institutions.

Advanced Encryption Tactics for Privacy

Encryption is vital for security, especially where privacy matters. Luxury Fintech uses advanced data encryption to protect user data. Thieves can't read stolen data. This level of privacy is critical for luxury financial transactions.

Examining the global luxury fintech market

The global high-end FinTech market is alive with new business ideas and elegant financial options. It caters to the wealthy. Analysts see a variety of luxury financial trends worldwide. They note changes in rich people's tastes and investment choices. This part cuts into these shifts, showing the blend of luxury and online ease for the wealthy.

Many places around the world are creating new hotspots for luxury FinTech. From New York's busy life to Singapore's modern offices, we see changes. Personal banking, investing in new companies, and rich people liking cryptocurrency are reshaping what they expect and want.

| Region |

Market Size |

Growth Potential |

Notable Trends |

| North America |

$XX Billion |

High |

Robo-advisory, Secure Payment Technology |

| Europe |

$XX Billion |

Steady |

Blockchain Integration and Wealth Management Apps |

| Asia-Pacific |

$XX Billion |

Exceptional |

Mobile Banking and Personalized Financial Services |

| Middle East |

$XX Billion |

Moderate |

Luxury investment platforms and AI-based solutions |

| Latin America |

$XX Billion |

Emerging |

Digital wallets and fintech startups |

Leaders in the global high-end FinTech market include not just big tech and old banks. New startups are also shaking things up with cool ideas. They are revolutionizing wealth management, payment processing, and client treatment. This is a whole new chapter of digital luxury. These financial services are also shaped by how customers behave and the rules in place.

"In an ever-evolving financial world, the fusion of luxury and technology is not just inevitable—it is already here, redefining wealth management and luxury lifestyle services," observes a leading financial analyst.

VIP banking and customized financial products

In high-net-worth banking, there's a big push for customized financial products and exclusive banking offers. This banking style is all about providing a very personal service to wealthy clients. They expect top-notch service and products made just for them.

Exclusive Credit Card Offers for the Affluent

Today’s wealthy shoppers want credit cards that fit their fancy lifestyles. Banks responded by issuing special cards. These offer luxury services, great travel perks, and entry to private events.

Tailored Loans and Financing Options

Rich individuals need tailored loans and financing options for big purchases or business ideas. Luxury banks offer loans and terms that suit each person's financial goals.

Building trust through personal financial advice

Wealthy clients value a trusting relationship with their banks. Personal financial advice from experts is key. This advice helps build a strong partnership based on financial goals.

| Service |

Benefits |

| Personalized credit cards |

The amenities include a luxury concierge, high reward points, and access to exclusive events. |

| Bespoke Loan Solutions |

Flexible rates and terms, tailored for large purchases and investments. |

| One-on-one financial advice |

Expert guidance, trust-based, aligned with financial goals |

Impact of Cryptocurrency on Luxury Spending

The rise of cryptocurrency has changed the luxury market. Now, rich people are using digital money to buy fancy things. This change shows how the rich handle their money and invest differently.

Luxury brands are now accepting cryptocurrencies to meet the demands of tech-savvy customers. This move helps them buy high-end products easily. It's a big step towards modernizing how we buy expensive things.

More and more luxury buyers are turning to cryptocurrency. This shift has made buying high-end items easier. Shoppers can now get everything from rare finds to top-notch properties with digital currencies.

Today, the big names in luxury retail are changing spending habits. They let customers use digital assets for affluent spending. An industry expert

- Adoption by high-end retailers and auction houses

- Exclusive artwork acquisitions via cryptocurrency

- Buying and chartering private jets and yachts using digital currencies

- The surge of cryptocurrency in luxury real estate deals is a significant development.

Cryptocurrencies break down old barriers with security and low fees. They're not just about making money. They make buying luxury items a smooth process. This shift is changing luxury spending into something more digital and decentralized.

There are now platforms just for buying luxury goods with cryptocurrencies. This shows how well luxury spending and digital money work together. For luxury brands, this means a chance to be innovative in a digital market. The blend of high-tech and wealth in spending is here to stay, shaping luxury retail's future.

The FinTech Luxury Scene offers numerous networking opportunities.

The merger of technology and luxury has created innovative financial services and a new place for elite financial networking. These exclusive networking circles are key to success in finance and technology. They help individuals and companies grow.

Elitist Events and Gatherings for the Wealthy

Top luxury finance events are essential for networking among the rich. These events are where people meet, make deals, and start partnerships. They take place in luxurious settings and attract big names, investors, and entrepreneurs.

Members-Only Platforms for Investment Opportunities

Exclusive online spaces provide wealthy investors with a unique investment opportunity. These private investment communities are more than places to grow wealth. They're also social spots for the rich to find new ventures and team up.

Collaborations are taking place between traditional banks and fintech startups.

With FinTech banking collaborations, the luxury finance world is changing. Old banks and FinTech startups are working together. They combine trust and new technology. This teamwork expands their networks and enriches the finance world.

Case Studies: Success Stories in Luxury Fintech Zoom

Luxury FinTech case studies show significant progress and change. They show how technology helps rich clients improve their finances and status. We look at stories of success thanks to luxury digital tools.

-

Revolutionizing Wealth Management: AI helped tailor investment plans for rich clients, leading to great growth.

-

Enhancing Secure Transactions: Biometrics and blockchain make transactions safer for savvy investors.

-

Expanding Financial Horizons: A family office used FinTech to enter global markets efficiently.

These case studies show how luxury FinTech adds value. They point to big leaps forward, matching tech with users' luxury needs.

| Client Profile |

Challenge |

Luxury FinTech Solution |

Outcome |

| Established Investor |

The need for personalized investment strategies |

AI-powered advisors customize portfolios. |

Portfolio growth outpaced market averages. |

| Rising Entrepreneur |

High-security asset transfer |

A blockchain-enabled transaction platform |

Secured and transparent, high-value deals |

| Family Office |

Global market entry |

Cross-border wealth management tools |

Successful international diversification |

In the world of luxury FinTech case studies, we see finance and tech marrying into a revolution. These stories show the rich, secure, and lavish opportunities FinTech and luxury finance bring to the world's elite.

The design of the user experience and interface is crucial in luxury fintech.

The fintech industry is constantly evolving. This is especially true in the luxury sector. Here, UX design in finance makes a critical difference. High-net-worth individuals look for more than just functionality. They want their financial interactions to bring aesthetic joy, too. Hence, a premium-interface FinTech experience is vital. In the upscale world of digital finance, user interfaces must be outstanding. They should reflect their clientele's luxurious nature.

A great customer-centric FinTech solution is more than just attractive graphics or a sleek look. It's about making an intuitive journey for the user. From logging in, going through portfolios, and making deals, every step should feel personal and exclusive. This turns UX design into not just a task but an art.

Why is elegance in user interfaces so important in high-end financial services?

- A great user interface shows the brand's dedication to quality and excellence.

- Easy and intuitive navigation leads to happier users who stick around for longer.

- Every point of interaction is a chance to build more trust in the brand.

Let's dig deeper into the key elements of UX/UI design in luxury financial tech:

| UX/UI Element |

Application in Luxury FinTech |

Outcome for End Users |

| Personalization |

Custom dashboards and tailored investment insights. |

Personalized interfaces boost confidence and loyalty. |

| Responsiveness |

Smooth experiences on all devices. |

Simple financial management, wherever you are. |

| Security Features |

Top-notch biometric logins and encryption methods. |

Ensures data safety, giving users peace of mind. |

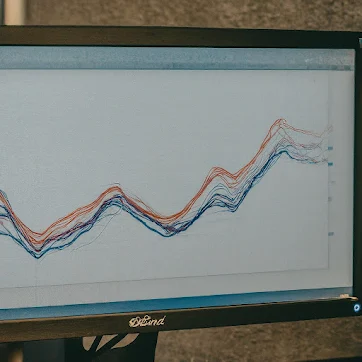

| Data Visualization |

Neat displays of complex financial details. |

Makes understanding portfolios and trends easier. |

| Interactive Assistance |

Live chat and customer service options. |

Quick assistance improves service satisfaction. |

FinTech companies that pour resources into exceptional UX design are leaders, not just followers. They define what wealthy clients should expect in the future. A premium interface signals a FinTech company that genuinely values its elite users. It shows they care about their time, security, and overall experience.

Conclusion

We've seen luxury and financial tech come together in exciting ways. We looked at innovations that show financial sophistication. This includes artificial intelligence, digital banking, and the growth of FinTech in luxury markets. These innovations are changing the financial services industry.

The mix of fintech and wealth management is shaping the future of luxury finance. We're excited about what's next. It promises more personalization and security in wealth management. This future will be rich and tailored to the needs of luxury living.

Luxury FintechZoom keeps you updated on the latest in high-end financial technologies. We're where luxury meets digital innovation. We design our content with quality in mind. We're excited to explore more opportunities with you in this ever-growing field.

FAQ

What is Luxury FintechZoom?

Luxury FintechZoom is a platform for wealthy people. It combines technology with finance. It provides news, analysis, and expert opinions on finance and investment for the wealthy.

How does technology enhance luxury financial services?

In many ways, technology enhances luxury financial services. It offers better security, personalized investment advice, and a better experience. For instance, wealth management apps give custom financial guidance and manage accounts for wealthy individuals.

What are some emerging trends in high-end financial management?

New trends are shaping high-end financial management. Sustainable and ethical investments are gaining popularity among the wealthy. There's a move to digital firms and a demand for services that blend lifestyle and wealth management.

What role does AI play in luxury fintech?

AI is transforming luxury fintech. It uses deep learning to create unique investment plans. AI chatbots improve customer service. It also uses data to make smart decisions in luxury asset management.

What are some advanced security features in luxury financial technology?

Luxury financial technology uses top-notch security. This includes biometric checks, blockchain for open transactions, and strong encryption to protect financial information.

Can you provide an overview of the global luxury FinTech market?

The global luxury FinTech market is wide and diverse. It includes market analysis and growth prospects. It highlights leading countries and global innovators in luxury financial services.

How are financial products customized for HNWIs through VIP banking?

VIP Banking makes financial products special for wealthy clients. It offers unique credit cards, loans, and personal advice. This builds trust and meets their specific needs.

What impact has cryptocurrency had on luxury spending?

Cryptocurrency is changing luxury spending. Wealthy individuals use it for large investments and purchases. It is now accepted by luxury sellers, too. This is shaping future luxury transactions.

How important is networking in the FinTech luxury scene?

Networking is key in the FinTech luxury world. Events and exclusive platforms let the wealthy connect. Tie-ups between banks and FinTech startups offer new networking opportunities.

What can readers learn from luxury FinTech case studies?

From luxury FinTech case studies, readers learn how new financial solutions help wealthy people. They enhance wealth, security, and access to unique investments.

Why are user experience and interface design important in luxury FinTech?

Good user experience and design matter a lot in luxury FinTech. They make sure digital products impress a selective clientele. This ensures easy and enjoyable use, keeping customers happy and loyal.

April 23, 2024

April 23, 2024

David Ray

David Ray